Group I base oils are solvent-refined base oils with a viscosity index range of 80 to 120. They have long been the cheapest base oils on the market but have shown considerable price and supply fluctuations lately. Nynas offers various options for the successful replacement of Group 1 base oils.

Group I base oils may have many application areas but in today’s world, money is not the only criterion when selecting base oils. Environmental concerns, supply security problems, higher performance expectations are driving manufacturers to seek Group I replacement strategies.

Nynas naphthenic base oils are offered with a broad range of viscosity and properties, and they can be used in several application areas including lubricating greases, metal cutting and removal fluids, metal forming fluids, industrial lubricants and refrigeration fluids among others.

At our webinar with Nynas, Thomas Norrby, Technical Manager and Senior Specialist, explained us how naphthenic base oils can be a good alternative to Group I base oils.

Base oil markets and market dynamics

There are around 700 oil refineries in operation globally, but only a small part of these refineries are producing base oils, around 150 base oil plants globally exist. They display a high degree of vertical integration in the crude to final product value chain. There are different base oil refineries built and adapted for Group I, II or III production. There are only a handful of standalone base oil plants in the world, globally less than 10. Nynas operates two of these standalone base oil plants.

Base oil refining industry is evolving. The pandemic is accelerating the ongoing trends. Requirements from the automotive industry drove demand for higher quality base oil, such a Group II, Group II+, Group III and triggered investments into new refining capacity. Consequently, Group I base oil production capacity was reduced from about 74 percent back in 2007 to around 30 percent of the total in 2020. About nine million metric tons per year of Group I has disappeared forever, though. However, nearly eighteen million tons per year on new Group II and almost seven million tons in new Group III capacity have been added during the same period of time.

Despite different specifications and different refining techniques, the various base oil groups compete in the same markets, and the total refining nameplate capacity has grown substantially. Base oil market has not expanded significantly in growth in recent years. And the finished lubricant demand has stagnated. This has led to a significant overcapacity in the base oil market and a significant decrease in Group I capacity.

Why is there a shortage of Group one base oil? There is a lower demand overall for crude based products, fuels, base oils, etc. The Group I base oil train is an add-on to fuel refiners, tied very much to the fate of the of the fuel refinery. It is not the main product category and is not the main driver of the business. The demand patterns are shifting and changing. There are also economic reasons. Base oil refining is not carrying the whole cost of the refinery if it is a standalone. But it is an important contributor in a typical base oil train and fuel refining.

The impact of the pandemic in the short term has been on lower demand for crude based fuel products, especially for aviation fuels. In the post Covid-19 reality, we can see that the deep green recovery will push electrical vehicles and further decreases the fuel demand. The base oil needs are changing as well. We had the impact of the severe winter early in 2021, which caused the short-term impact on availability and highlighting the connection and the need for formulation and flexibility in many applications.

Key physical properties of base oils

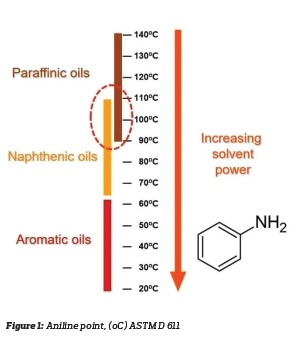

There are key physical properties that are important for the base oil formulator and for the end user. These are viscosity, viscosity index, density, volatility, flash point, pour point and aniline point. Solvency is another key property that dictates compatibility with polymers and resins. It sets limits to a pigment and filler wetting, in lubricants, the additive loading. Saturation limits are very dependent on the solvent power of the base oil. It affects emulsion stability and solubility of impurities that arise due to oxidation or to wear during operations. The oxidation products themselves need to be soluble in the oil. Otherwise, there will be sludge formation, filter blocking or varnish.

ASTM D 611, the aniline point test, shows us that the lower the aniline point, the more polar the oil and the higher the solvent power. As can be seen in Figure 1, aromatic oils are in the low mid temperature range where aromatic oils and aniline readily dissolve. Naphthenic oils are in an upper zone where it displays an important overlap with paraffinic oils. This overlap means that the formulations that work in this range will work equally well in Group I and naphthenics.

Properties of the NYBASE range

Nynas has a wide product range, including BBT grades that blend with asphaltenic oils, and naphthenic grades: T grades, NS grades, S grades and NYBASE grades.

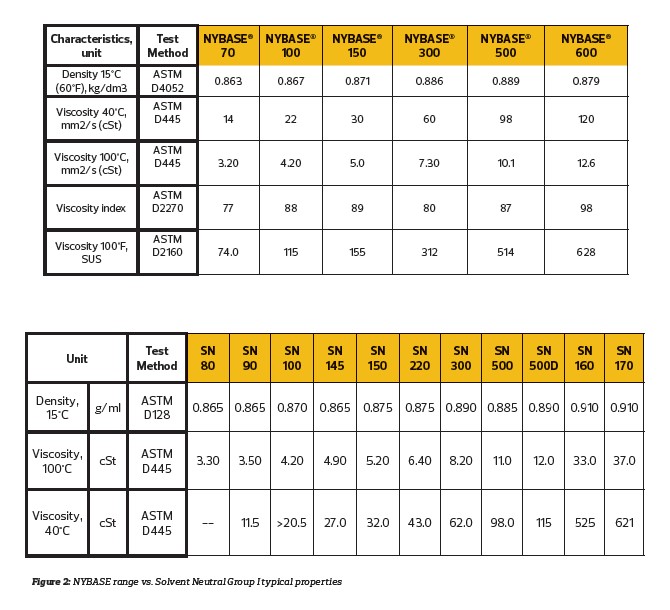

NYBASE grades are the Group I replacement products. They closely match the kinematic viscosity and aniline point of the Solvent Neutral (SN) Group I paraffinic base oil ranges. It allows industrial lubricant manufacturers to maintain key properties of their products by offering retained viscosity and solvency properties. These key properties are quite different in Group II base oils. NYBASE’s allow direct drop-in Group I replacement or with minimum re-formulation work needed. It has been successfully proven in many applications since their launch. And minimal labels, PDS and other marketing material changes are required.

Many application studies with NYBASE have been made by Nynas and by other lubricant blenders. NYBASE range is compared with a typical Solvent Neutral Group I. In this case, it is from the Repsol product range. As you can see in Figure 2, there are a number of parameters describing the properties for the base oils. Many properties closely match. For example, NYBASE 100 compares well to the SN 100 with the same viscosity and the same aniline point. NYBASE 150 is a tit for tat for the SN 150 with same viscosity, the same solvency, and the same aniline point. Furthermore, we see that the key characteristics are mirrored between the NYBASE 500 and this SN 500.

NYBASE 500 Group I replacement base oil meets the viscometrics typical for the SN 500 grade. It has a VI of 87, a flash point COC 240 oC, very good poor point, good low temperature properties. It is low in sulfur and its aniline point is 111 oC, right in the middle of the useful range.

Other routes to Heavy Neutrals

There are other routes to have SN 500 or SN 600 at 100 to 120 centistokes. It is possible to use NYNAS T 400 and blend with the Group II like VG 46 (N 220). Different proportions will give SN 500 or SN 600 type products with viscosity index above 80. It is also possible to use NYNAS T 600 and a similar Group II VG 46 with a suitable VI improver to make SN 500 or SN 600.

- NYNAS T 400 (45%), Group II VG 46 (N220) (55%) to make SN 500 (VI 86)

- NYNAS T 400 (53%), Group II VG 46 (N220) (47%) to make SN 600 (VI 80)

- NYNAS T 600 (41%), Group II VG 46 (N220) (59%) + VI improver (ca 5%) to make SN 500

- NYNAS T 600 (45%), Group II VG 46 (N220) (55%) + VI improver (ca 5%) to make SN 600

These are additional routes to make the SN 500 and SN 600 that can be then directly used in making new blends and finished products.

Direct routes to Paraffinic Brightstock

There are some direct routes to Paraffinic Brightstock in the viscosity range 500 to 625, corresponding to the BS 160 – BS 170. We can use NYNAS T 400 with Group II Neutral 500 and add VI improver. We can also use NYNAS T 600 with Group II N 500 and VI improver. This option is used commercially in Egypt with very successful results. They are making Brightstock with the same properties of the VI 93 and 500 centistokes. We can also make the heavier Brightstock by using more T 600 with Group II N 500, and some VI improver to have properties close to what is normally found in these heavy Brightstocks.

- NYNAS T 400, Group II N 500 and VI improver

- NYNAS 600 (50%), Group II N 500 and VI improver (500 cSt, VI 93)

- NYNAS T 600 (70%), Group II N 500 (30%) and 10% VI improver (620 cSt, VI 98)

Conclusions

Nynas has a wide range of options for Group II Solvent Neutral replacements covering from 70 to 600 SUS, 14 to 120 centistokes. Nynas has a very wide customer offer in the 500 SUS/100 cSt range (six different base oils in all). Re-refined Group II base oils are quite commonly found and they can be upcycled to SN 500 and SN 600 by blending with naphthenic oils. Routes to paraffinic Brightstock type replacement products have been pioneered. Moreover, target blends like SAE 40 with viscosity of 135 cSt or so does not necessarily have to go via a 500 cSt Brightstock, you can design the base oil blends with this SAE 40 grade or SAE 50 or whatever you like in mind right from the start.

The base oil supply landscape is forever changing. High viscosity and high solvency Group I base oils are disappearing forever. Naphthenic base oils provide solvency and high viscosity and are here to stay. Naphthenic base oils blend very well with Group II and Group III base oils. Desired properties of any Group I base oil can thus be recreated that in skillful blending of naphthenics and Group II or Group III base oils. Nynas offers a ready-made solution in the form of the NYBASE base oils, and a wide range of application support and lubricant model studies have been completed already.