The European base oil market began 2023 with falling Group I and Group II prices weighed down by sluggish demand and oversupply. Buyers remained reluctant to replenish stocks while prices extended their fall and uncertainties about of the impact of the EU’s full embargo on Russian volumes from 5 February.

Some refiners began the year with larger-than-usual inventories. Some blenders are also carrying large stocks of finished products. These stocks include lubricants made from base oil bought when prices peaked in June. These higher-priced lubes have limited outlets outside of Europe because their retail value is too high in many export markets.

Weaker-than-usual demand coupled with the conclusion of regional Group I maintenance and extended shutdowns added to a build-up of surplus supplies in the second half of 2022. This persistent surplus overhang placed downwards pressure on Group I and Group II prices. Refiners and suppliers heavily discounted their base oil to help clear stocks. But limited export options were available amid a global demand slowdown and supply surplus.

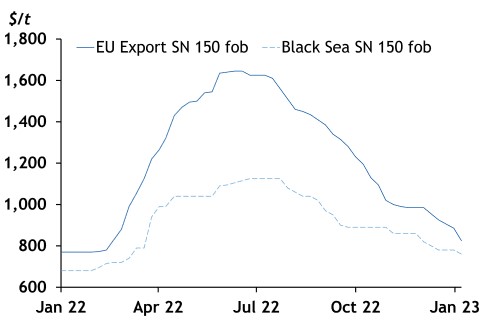

In January, Argus export spot prices for Group I SN 150 and domestic Group II N150 fell by 46.2pc and 28.9pc respectively from their peaks in June 2022.

Many European buyers curbed base oil imports shortly after Russia’s invasion of Ukraine at the end of February 2022. EU sanctions on Russian banks and payment systems and bans on shipments from Russian ports and Russian flagged vessels, also helped impede base oil exports to Europe.

This coincided with high inflation in Türkiye with a weakening Turkish lira compared to the US dollar. Despite falling prices, European export prices remain uncompetitive in Türkiye following an influx of lower-priced Russian base oils.

Türkiye prioritises Russian, Asian imports

Türkiye has become a major export destination for displaced Russian base oil no longer moving to Europe. Without official sanctions announced by The Turkish government has not placed office sanctions on Russian supplies. Increasingly lower Black and Baltic Sea prices have made Russian supplies attractive to Turkish buyers. Argus spot export European and domestic Turkish Group I SN 150 prices peaked at 49pc and 55pc above Black Sea prices in June 2022.

Inconsistent production at Turkey’s sole Group I refiner Tupras’ 400,000 t/yr Izmir refinery also prompted more domestic blenders to secure Russian imports. Firm demand for premium-grade lubricants has supported steady demand for Group II supplies from Asia-Pacific.

In January, Argus spot prices for European N600 on an fca ARA basis rose 20.3pc above fob US Gulf coast prices and 81.7pc above N500 fob Asia prices. Several key Asian Group II suppliers have secured storage in Türkiye and easing freight rates for container vessels are supporting a steady flow to that market.

Easing financial constraints in west Africa and more approved lines of credit for buyers has seen over 20,000t of European base oil move to the region from end-December. Increased competition with Russian volumes in usual outlets like Türkiye has prompted European producers target other export outlets such as Nigeria to clear their excess stocks. Producers are also targeting other export markets in the Mideast Gulf and India to clear their surplus overhang.

Global overview

Macroeconomic developments, geopolitical tensions and the Covid-19 pandemic have clouded the impact of a shift in base oil fundamentals. Prices continue to be heavily influenced by supply-side shocks from a slew of logistical complications and volatile feedstock values. While prices are now trending closer to expectations, the pace of any adjustment depends on the rate at which these complications ease.

Prices for the lubricant feedstock have risen to some of their highest levels in a decade. Elevated crude and competing fuel values have pressured base oil prices from the baseline. A series of base oil plant maintenances has trimmed supply availability further. The result is higher prices in all regions.

Yet prices in some regions have risen more than others. This highlights regional production capacities and the susceptibility of regional participants to logistical complications. Europe, for example, relies heavily on imported Group II supplies from producers in the US and Asia-Pacific. High freight rates and longer delivery times resulted in a supply shortfall and higher Group II prices in Europe relative to other regions.

With easing logistics, regional spreads are set to adjust closer to expectations. Some have already narrowed. US Group III prices were at a record-high versus other regional prices in early 2022, reflecting a dearth of Group III production capacity in the region. The price premium has since fallen as more producers divert supplies towards the US market.

As arbitrages narrow, outright base oil prices are set to hold firm in the first half of 2023. Base oil demand typically rises ahead of the spring oil-change season. In major importing countries like China and India, market activity also usually rises before and after the lunar new year holidays and before the end of India’s fiscal year in March.

High competing fuel values will likely provide additional price support. Some base oil grades are unusually weak and at a discount to gasoil and diesel values. This incentivises producers to divert more feedstock towards the middle distillates pool, if they have the flexibility to do so. Such a move would exacerbate supply disruptions from a series of scheduled plant maintenances in the first half of 2023.

Any price rise is expected to be muted compared to previous years. Rising interest rates to curb record-high inflation increases the cost of borrowing and will likely weigh on market activity. Lubricants’ demand is typically fairly robust as lubes are required to keep machines running. But demand also tracks economic growth, industrial activity and automotive sales.

A series of regulatory and specification changes like China’s and India’s Stage VI emission standards and the ILSAC GF-6 and Dexos Gen 3 engine oil specifications is set to shift demand towards premium-grade base oil. The price impact has so far been clouded by supply-demand side shocks. It also coincided with rising production capacity. Since 2018, close to 3mn t/yr of premium-grade production capacity has been added in China alone. The repercussion is rising supply availability among producers, especially in Asia-Pacific, that had been targeting the Chinese market.

You can explore these issues and much more at the Argus Global Base Oils Conference on 20-22 February 2023, in Central London, UK. Explore how geopolitics is affecting the availability and supply of base oils across Europe in discussion with DYM Resources and Penthol. Changing lubricant formulations for PCMO and HDDEO businesses, alongside developments in petroleum, re-refined, synthetic and bio-based lubricants is discussed by industry experts and innovators such as Lubrizol and Nuspec Oil. Avista Oil, Tayras, Nynas, MAN ES, Maersk and more will share insights on marine lubricants, re-refined base oils and macroeconomics. Visit the website to view the latest agenda: